How to Grow Your Business with Real Estate Investors

Learn how understanding and serving the needs of real estate investors can help mortgage brokers grow their businesses during all phases of the real estate cycle.

It's no secret. The mortgage industry has faced enormous headwinds in the last year. Wars, geopolitical sanctions, supply chain issues, and an increase in the money supply caused by Covid-19 relief programs drove inflation to a 40-year high in June 2022. This prompted the Federal Reserve to increase the Federal Funds rate over the last year to a 15-year high of 4.83% in April 2023.

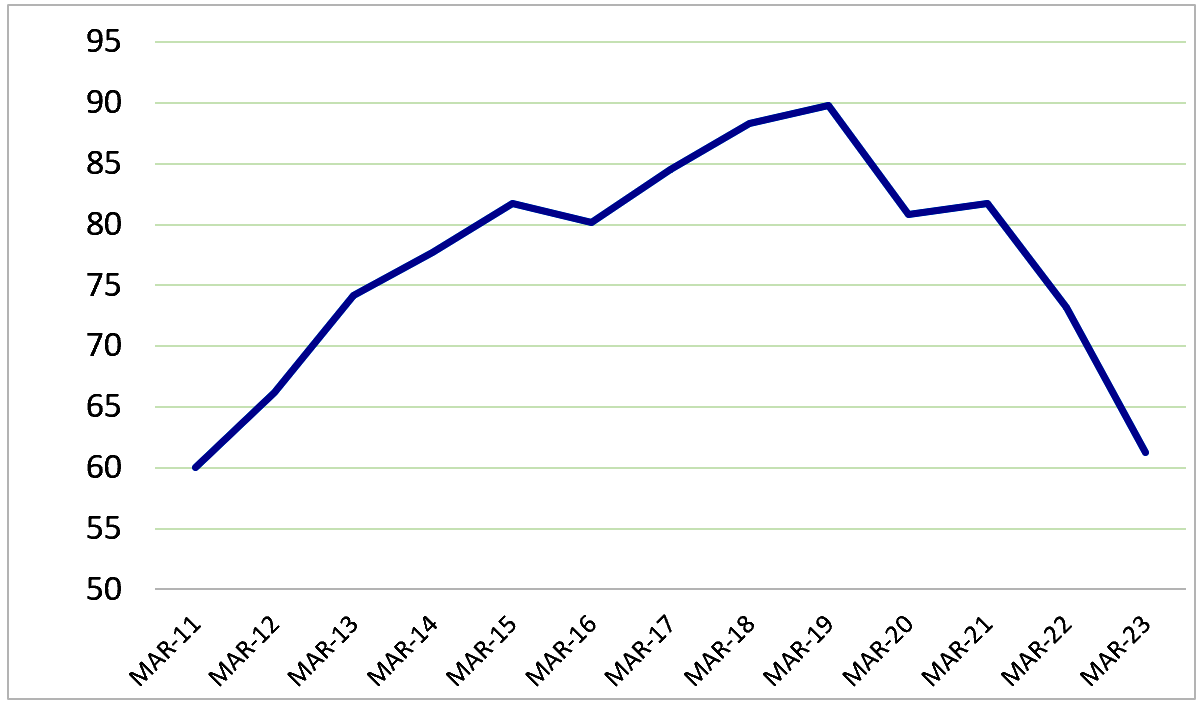

Meanwhile, rising mortgage rates and limited housing inventory have made home ownership difficult for most consumers, driving many home buyers to the sidelines. And the outlook for 2023 presents a challenge for many brokers. The Fannie Mae National Housing Survey Home Purchase Sentiment Index (HPSI) is at its lowest rate since March 2011.

National Housing Survey Home Purchase Sentiment Index

A new Zillow survey found that more than half of young Americans believe they must win the lottery to afford a home. At the same time, concerns of a pending recession keep one-third of Americans from buying homes, according to a survey by Assurance. And these concerns are not unwarranted.

Signs Point to a U.S. Recession by 2024

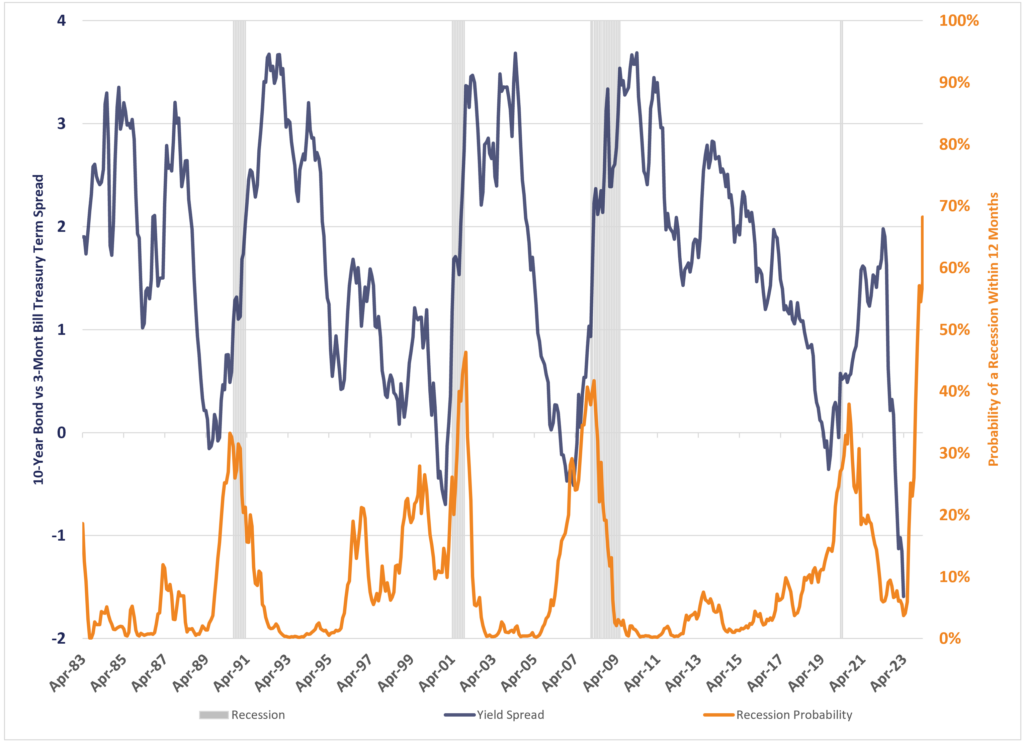

Economists typically rely on an "inversion" in short and long-term interest rates, expressed as the difference or "spread" between the 10-year Treasury bond and the 3-month Treasury bill. The probability of a recession within the following 12 months increases whenever this spread is negative or inverted.

How accurate is an inverted or negative yield curve in predicting a recession? The chart below shows that the U.S. economy experienced four periods with an inverted yield curve over the last 40 years. These occurred in June 1989, December 2000, November 2006, and August 2019. In each case, a recession, illustrated by the gray bars in the chart, followed shortly afterward. In April 2023, the yield spread hit its lowest rate in 40 years, increasing the probability of a recession within the next 12 months to 68%.

Probability of a U.S. Recession

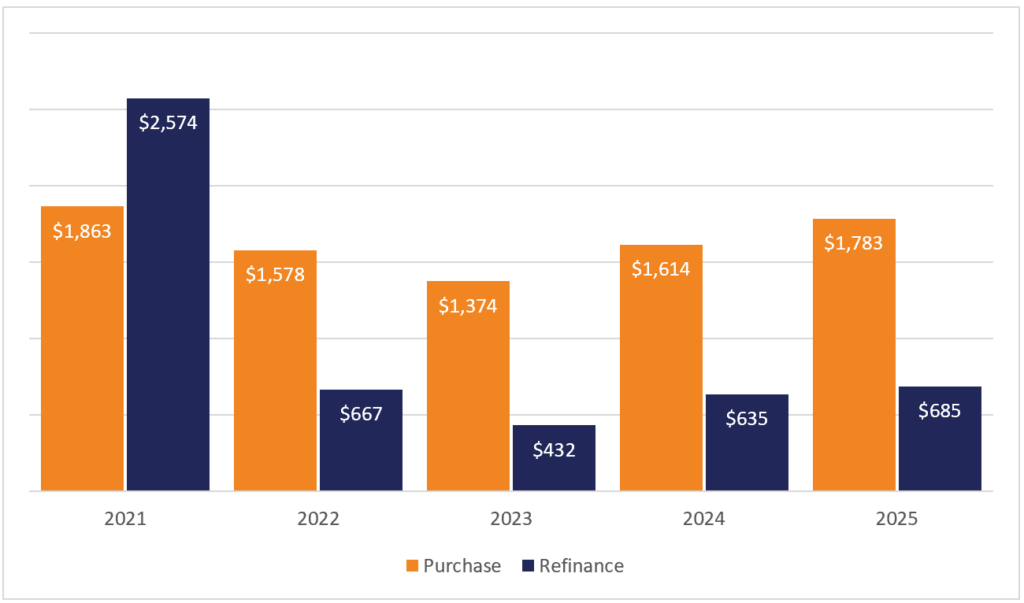

Mortgage Finance Transactions Forecast

Of course, many brokers already feel these issues' effects on our industry. And conditions are expected to get worse in 2023 before they get better. According to its revised April 2023 Mortgage Finance Forecast shown in the chart below, the Mortgage Bankers Association (MBA) estimates an 83% drop in refinance transactions for 1-4 family properties compared to their recent high in 2021. And purchase transactions are estimated to be 26% lower in 2023 than in 2021. This was after a considerable decline in refinance transactions in 2022 caused by the rise in interest rates. The MBA revised its estimates for 2023 over a growing concern for a coming recession.

Total 1-4 Family Purchase/Refinance Mortgage Originations in Billions

Navigating the Market Ahead of Us

It's safe to assume that many brokers are looking for ways to replace some of the revenue lost over the last two years. With a pending recession on the horizon, the consumer housing market is more likely to worsen before it gets better. When faced with this level of uncertainty, the best strategy is to diversify your business to find new opportunities and reduce its exposure to continued risk. And one way to do this is to shift the focus from consumer home loans to real estate investors.

Consumers, Investors, and Recessions

The Consumer Home Buyer

During a recession, consumers are more likely to be cautious about losing their jobs and income.

They are also more hesitant to make a big purchase since they typically have a short-term investment horizon. This makes them more reluctant to take on homeownership costs during a recession.

When looking at homeownership, consumers primarily focus on the short-term question: "What's my rate?" If the rate makes homeownership too expensive, they wait for rates or housing prices to drop. Others wait for more certainty in employment or wage increases once a recovery begins.

Notably, many consumers who refinanced their homes during the 2020 recession at the lowest rates on record will likely never need to refinance their mortgages again. This removes many of these borrowers from the mortgage market, forcing brokers to attract new clients.

The Real Estate Investor

In contrast, independent real estate investors are more opportunistic since they have a much better understanding of the real estate market. Investors often view recessions as an opportunity to buy properties at a discount, and they tend to have a long-term investment horizon that lets them see beyond the recession.

In contrast, independent real estate investors are more opportunistic since they have a much better understanding of the real estate market. Investors often view recessions as an opportunity to buy properties at a discount, and they tend to have a long-term investment horizon that lets them see beyond the recession.

Independent investors are also more transactional and less concerned about rates. They tend to focus more on the speed and ease of financing to close deals quickly. Their primary goal is to acquire the property and start monetizing the debt. The expense of a higher interest rate can be hedged by increasing rents or refinancing the property once rates drop. This alone creates a multi-deal opportunity for mortgage brokers.

Most important, investors are better positioned to weather a recession through passive income from their rental properties. After all, when consumers aren't purchasing homes during a recession, they rent.

Since investors have a better understanding of the real estate market, they are typically one step ahead of consumers. Therefore, investors, not consumers, will be the first to jump back into the market if the predicted recession occurs.

Finding the Right Message for Investors

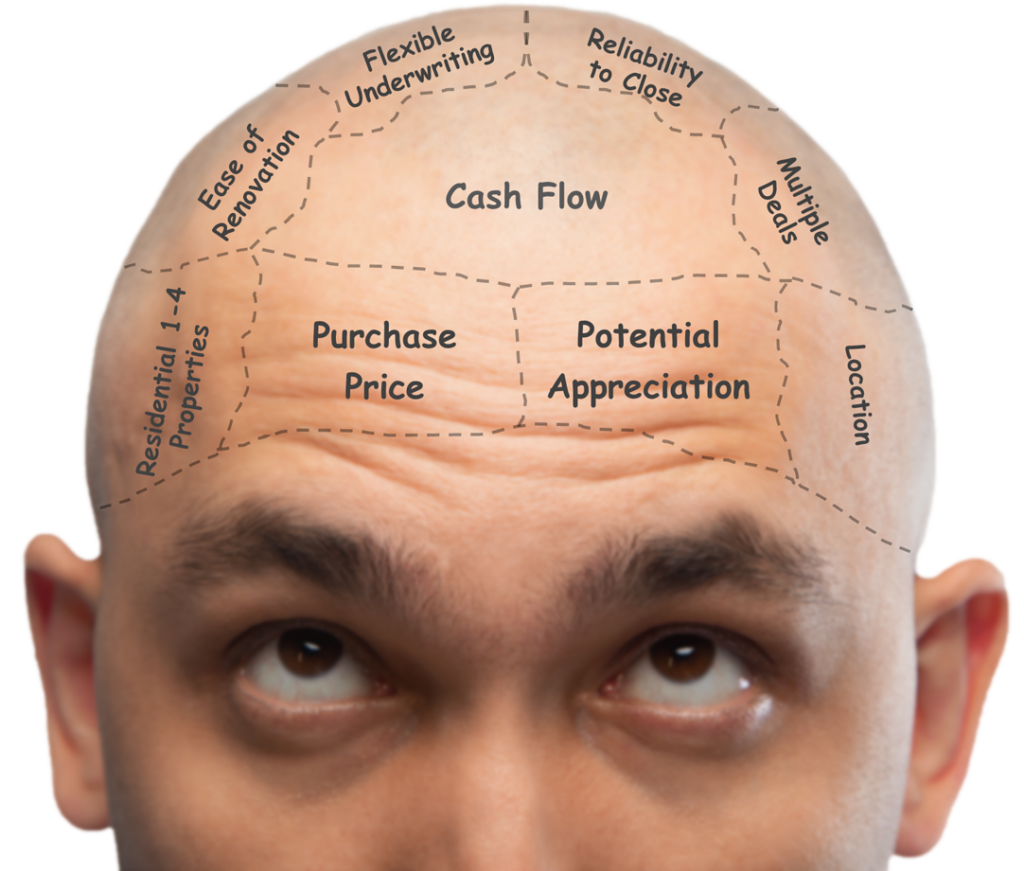

Whether you're already servicing real estate investors and small business owners with their real estate holdings or considering it as a way to diversify your business, knowing the needs of investors is essential to your success. That's why we commissioned a market research study among real estate investors and small business owners in 2019.

Our WIN study, an acronym for What Investors Need, identifies the critical criteria investors use to find and evaluate potential investment properties, including what they expect from mortgage brokers and finance companies. The study also explored the differences between borrowers seeking funding from traditional lenders and those who prefer working with alternative, specialty finance companies like Velocity.

A total of 287 residential and small commercial property investors were interviewed. Survey participants were randomly screened and contacted by a large, multi-sourced Internet research panel of several million households. All participants had purchased or refinanced a residential investment or small commercial property in the last ten years.

While this article provides a summary of the WIN study below, you can explore the complete findings and implications of the study here.

#1 Cash Flow is King

First and foremost, cash flow is the number one priority for real estate investors because it measures a property's profitability. After all, investing aims to grow wealth over time, and investors must ensure the property's cash flow achieves this goal.

Several factors can affect a property's cash flow, including the rent charged, the cost of operating expenses, and the amount of debt owed on the property.

While experienced real estate investors can quickly evaluate a property's cash flow on the back of a napkin, brokers can help by researching comps for other rental properties in the same area. Cash flow is critical to determine if the property will meet the debt service coverage ratio (DSCR) required by traditional lenders. When it doesn't, the broker can suggest an alternative, asset-based lender that emphasizes the property's appraised value over debt coverage.

#2 Purchase Price

The purchase price of a property is vital to real estate investors because it is the foundation of their investment. The lower the purchase price, the more potential profit for the investor. Additionally, a lower purchase price can help to offset the costs of owning and operating the property, such as mortgage payments, taxes, and insurance.

While consumers purchase real estate as a place to live and grow a family, real estate investors seek to profit from their investments to expand their portfolios and increase their wealth.

#3 Potential Appreciation

Potential appreciation is understandably essential to investors, particularly among fix-and-flip investors, since it affects the total return on their investment. However, appreciation also builds equity in the property that long-term investors can use to finance future acquisitions and expand their real estate investment portfolio to increase their passive income.

#4 Residential 1-4 Properties

Independent real estate investors prefer residential 1-4 investment properties as they provide a relatively low investment threshold compared to multifamily and commercial properties. It is also easier to identify their appraised value, calculate their income potential from rental comps, and estimate their historical appreciation over time than commercial properties.

Because there are hundreds of millions of residential 1-4 properties in the United States, it's also easier for investors to find them. On average, the typical real estate investor owns 4.5 SFR properties since owning multiple properties limits vacancy risk. If one of their properties has a vacancy or declines in value, the other properties they own may still be profitable.

#5 Ease of Renovation

Rehab costs are important to real estate investors, particularly among fix-and-flip investors, because they can significantly impact the profitability of a deal. The higher the rehab costs, the lower the potential profit margin. They can also affect the amount of debt investors assume, and the capital gains realized when the property is sold.

#6 Flexible Underwriting

Flexible underwriting is essential to many independent real estate investors because it allows them to qualify for loans even when they don't meet traditional lending criteria. This can be especially helpful for self-employed investors with irregular income or blemishes on their credit report.

#7 Certainty to Close

Certainty to close is essential to investors because it ensures that they can acquire the property they have agreed to purchase. When brokers can quickly evaluate a potential deal and provide conditional loan approval, investors can plan for finding tenants, making repairs, or starting renovations. If the deal falls through, it can also reduce their risk of losing money on inspections, appraisals, earnest money, and other closing costs.

#8 Multiple Deals

While the average consumer purchases a home every 8 years, real estate investors allow brokers to fund multiple deals, which may include blanket loans to finance more than one property. Blanket loans can be a more efficient way for real estate investors to invest in a portfolio of properties as they can save on the costs of origination and closing.

#9 Location

Location is often a key consideration for real estate investors since it often impacts the value of a property, the amount of rent that can be charged, and the ease of finding tenants. Key factors that impact location include demand, amenities, transportation, crime, and schools. Properties in key locations appreciate faster over time.

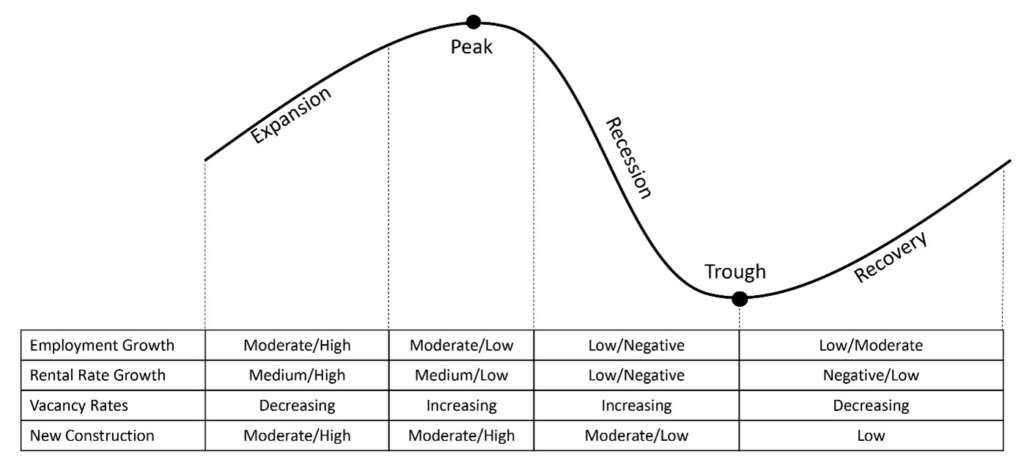

The Real Estate Cycle

As illustrated below, the real estate market typically follows a four-stage cycle that includes periods of expansion, recession, and recovery, with a peak and trough that identify a market transition. These four periods are primarily defined by four factors: employment growth, rental rate growth, vacancy rates, and new construction. This cycle can happen on a national level or separately in different markets depending on local economic conditions.

Researchers believe the typical real estate cycle lasts from 10 to 18 years. The current 15-year recession, recovery, and expansion cycle began with the mortgage market meltdown in 2008 and is the most extended cycle in the last 60 years.

How Consumers and Investors Differ

Consumers' participation in the real estate market is typically more dependent on economic conditions than real estate investors. When the economy is strong, consumers have more money to spend and are more likely to buy homes. When the economy is weak, consumers have less money to spend and are less likely to buy a home.

Consumers are also more sensitive to interest rates than investors, and buying a home becomes more affordable when rates are low. Investors are less susceptible to interest rates and can remain active even when rates rise.

Job growth, housing affordability, and consumer confidence also influence consumer participation in the real estate market. When job growth increases, consumers are more confident about the economy and more likely to purchase a home. When housing is affordable, consumer demand for homes increases. The same cannot be said for investors. Investors know that a drop in consumer home buying leads to an increased demand for rental properties.

If you are currently offering investment property loans to real estate investors or plan to do so in the future, you must understand how real estate investors actively adjust their investment strategy. Like hockey players skate to where the puck is going, real estate investors make decisions based on where they believe the market is heading and not on where it is today. Investors will buy if their calculated return on a particular property meets their investment criteria and liquidate properties when they don't.

How Investors Navigate the Real Estate Cycle

Expansion Phase

During the expansion phase of the real estate cycle, investors are typically more active. As the demand for housing increases, vacancy rates drop, and rents increase, making it easier to achieve a positive cash flow. The oversupply in properties from the recession is absorbed faster than during the recovery phase. Since properties are more likely to increase in value during this phase, the risk decreases for both the investor and the lender, which tends to support lower interest rates.

As housing prices appreciate, long-term investors may also reinvest their profits from previous investments to buy more properties and expand their portfolios. It's also normal to see an increase in rehab loans from fix-and-flip investors during this phase. Small commercial deals also increase during this cycle phase as small business owners know this period as an excellent time to expand their businesses.

Many investors often reinvest their profits from previous investments to buy more properties and expand their portfolio through a cash-out refinance. Others may simply fix and flip properties during the expansion phase to capture a quick profit and move on to do the same with another property.

Investment in small commercial deals (retail, warehouse, etc.) also increases in the expansion phase as small business owners see this period as an excellent time to expand their business.

Peak Phase

During the peak phase of the real estate cycle, investors have a more challenging time finding good deals due to higher prices and lower inventory. As a result, the market becomes highly competitive, and time on the market drops, so investors will look to brokers for a quick close.

Purchasing properties at this time comes with increased financial leverage and risk. Some investors may stop buying properties and hold out for more favorable conditions, while others may stick to their criteria and selectively purchase properties that meet their investment goals.

Knowing that the peak phase could be followed by a recession, some investors will liquidate their non-performing assets to capture appreciation for use when property values decline.

Recession Phase

During a recession, demand for housing drops and inventory increases as people shelter in place. As a result, prices fall, and time on the market increases. Rent growth also stalls or declines during this phase.

Experienced investors typically navigate a recession by purchasing distressed properties for pennies on the dollar while avoiding small commercial properties due to increased business failures. Since many lenders, particularly banks, tighten their criteria during a recession due to increased risk and declining property values, financials on many investment properties may not pan out in the short term. When this happens, investors often turn to alternative lenders for funding but may incur higher costs as appraised values may be lower than estimated.

Recovery Phase

The recovery phase of the real estate cycle is considered the best time to invest in real estate. This is because the number of buyers in the market is limited, while supply is readily available. Prices typically drop to where investors can find investment properties with favorable yields and cash flows.

The recovery phase is an excellent climate for risk-taking investors to acquire properties at deep discounts. However, timing is critical, and investors entering the market too soon may see further declines in value if economic conditions reverse. It's equivalent to stock investors trying to time the market.

During this phase, traditional bank financing may be limited as banks may not be aligned with the same sentiment as investors. Again, an alternative, asset-based lender is often the best option for investors during the recovery phase, especially if banks are still in risk management mode.

Where Are We Now?

As of April 2023, the inverted yield curve is signaling a 68% probability of a recession within the next 12 months. At the same time, the factors that define the different stages of the real estate cycle are starting to lean in the same direction.

- Employment growth has declined by 61% since April 2022. This FED index reflects what firms expect about the growth of their own employment levels over the next 12 months.

- According to CoreLogic, single-family rental rates experienced 13 consecutive months of growth from March 2021 through April 2022. Since then, rental rates have seen 10 straight months of decline, from a 14% high in October to 5% in February 2022.

- According to Trading Economics, new construction, represented by housing starts, has declined by 21% from April 2022 to March 2023.

- Based on data from the St. Louis FED, the rental vacancy rate in the United States has steadily declined from 11.1% in Q3 of 2009 to 5.8% in Q4 of 2022, which is only 2 basis points above a 5.6% low in Q4 of 2021. (During a recession, vacancy rates tend to increase.)

As of the publishing date of this article, only three out of the four factors identifying each real estate cycle phase have been met. Therefore, the data suggest we are in the late stage of the peak phase in the real estate cycle. Any increase in vacancy rates could be viewed as the start of the recession stage. However, some of these factors may oscillate for several months before moving in a specific direction. It's also essential to understand that not all local markets follow the national trend. So, you must do your own research for the market in which you do business.

Why Diversifying Your Business by Offering Investment Property Loans is Essential

As in stock investing, trying to time the market and catch the bottom is difficult, if not impossible. And waiting for interest rates and housing prices to drop may take several months if not years. The best strategy is to learn what investors need during each real estate investment cycle phase, diversify your business, and align its resources to meet those needs.

Consumer home buyers were the first to react when interest rates rose. However, real estate investors will remain active throughout a recession and likely lead the market toward recovery. This presents an opportunity for brokers willing to diversify their businesses to serve investors' needs.

To learn more about our investment property mortgage programs, broker marketing resources, and digital LOS capabilities, click here.

References

- Fannie Mae, April 7, 2023

National Housing Survey - Scotsman's Guide, April 18, 2023

Survey: Recessionary concerns keeping one-third of Americans from buying homes - Zillow Press Release, April 19, 2023

More than half of Gen Zers and millennials believe they'd need to win the lottery to afford a home. - CoreLogic, April 18, 2023

CoreLogic: U.S. Annual Rent Growth Declined for 10th Straight Month in February - St. Louis FED, January 21, 2023

Rental Vacancy Rate in the United States - Trading Economics, April 2023

United States Housing Starts